Cloud-Based Payroll Software

Our payroll software pays more than 2.3m employees across the UK and Ireland every month

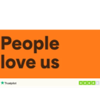

Secure, automated payroll from the cloud experts

Paycircle is an HMRC recognised, RTI compliant payroll system that pays employees on time, every time.

Manual payroll processing can be a drain on resources, which is why Paycircle does all the heavy lifting with full automation and customisable reports - freeing up time to focus on other essential activities without costing anything more in time or resources.

If you’re an SMB looking for secure and easy-to-use payroll software, speak to one of our friendly payroll experts today.

Why our payroll software is different

Paycircle isn’t like other payroll systems. Created through a unique collaboration between designers and payroll specialists, it’s easy to use and affordable for smaller businesses too. With features and functionality including, but not limited to:

Run payroll in seconds with no-click processing

Harnessing the power of automation, our software streamlines and simplifies payroll processes for busy SMBs. From submitting pension files, scheduling HMRC tax payments, and generating payslips, our automated payroll software can auto-run your payroll in seconds on a monthly, weekly, or bi-weekly basis - for as many people as you like.

Proactive alerts that keep you compliant

Paycircle has three types of payroll alerts to help ensure you have eyes on everything, and, importantly, that you remain compliant. Whether it’s a simple notice that something has changed, a warning alert that needs to be checked or an error alert that something urgently needs your attention, you can rest assured that you’ll be made aware of all potential issues before running payroll.

Stay in control with full payroll visibility and avoid the cost of payroll errors.

Proud to be trusted by UK SMBs

Discover the benefits of cloud-based payroll software

Connect your workforce with integrated payroll software

Paycircle payroll software integrates seamlessly with our HR software for SMBs, providing you with a more joined-up view of all of your HR data.

With an integrated HR and Payroll software, data related to key HR functions such as absence or shift management, flows instantly and directly to payroll, reducing the risk of costly errors and manual processing. . With all employee information held securely in one place, you can make informed decisions about your people, your budgets and your business.

Learn more about Payroll Software

Payroll software FAQs

What is payroll software?

Payroll software is a cloud-based or on-premises solution for paying your staff. It increases the accuracy of inputting and managing all payroll data, guaranteeing that employees receive the necessary payment on time.

With an approved payroll software, you can comply with the government’s tax requirements, provide customised and automated payments, and keep track of all payroll documents in one place.

Visit our guide on What is Payroll Software to find out more about how it works, features, and benefits.

Why does payroll software need to be HMRC accredited?

Payroll software needs to be HMRC accredited so you can report crucial PAYE data online. If you’re a new business, you’ll need to register as an employer with HMRC to get the references you need to start paying your employees through payroll software.

Why do small businesses need payroll software?

Small businesses need payroll software to help them manage their payroll efficiently and accurately. Payroll software can automate many of the manual tasks associated with payroll, such as calculating wages, withholding taxes, and generating paychecks. This can save small businesses a significant amount of time and money, as well as ensure that they are in complying with UK payroll laws and regulations.

How do we know if we’re outgrowing our in-house payroll?

Managed in-house payroll refers to payroll processing that is handled internally, often using spreadsheets and basic payroll processing. In-house can be comfortable because it's inexpensive and your business has full control, but you may be outgrowing it if you’re seeing payroll errors or increased growth.

The next options for your business could either be scalable payroll software, or payroll outsourcing. Find out more in our managed in-house payroll vs outsourcing payroll guide.

We are trusted by experts