As modern businesses continue to evolve, they are replacing more and more manual processes with digital alternatives. One such innovation is the implementation of payroll software.

No matter how large or small your organisation, payroll software offers many great features to improve accuracy and efficiency when paying your employees. From supporting PAYE compliance and reporting to minimising manual tasks and errors, the many different solutions available on the market today offer a wide choice of functionality to suit your needs and budget.

In this article, we’re going to take a look at the benefits of payroll software in more detail. We’ll also explain how payroll software works, and how to choose the right system for your organisation.

How payroll software works

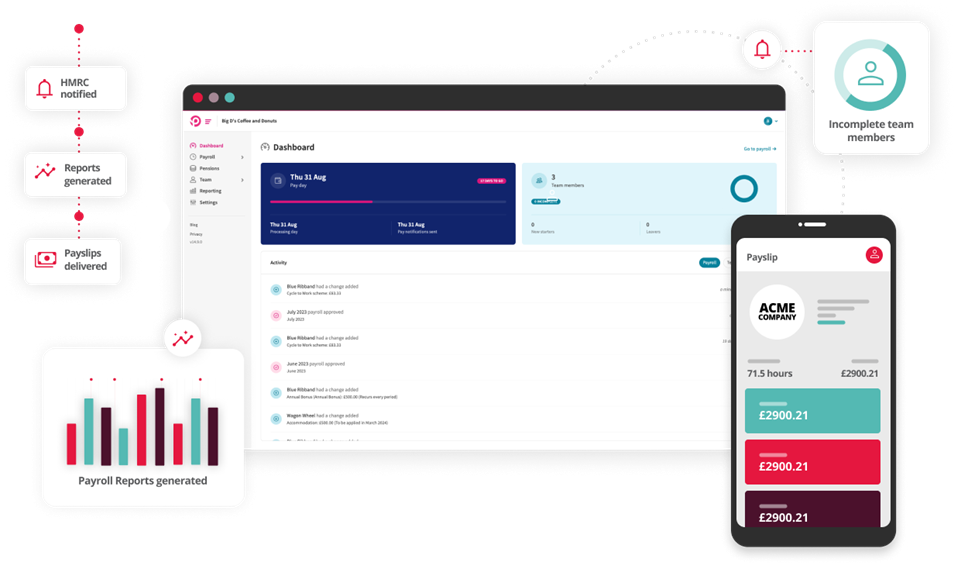

Payroll software connects seamlessly with other business and admin systems, allowing HR professionals to manage all aspects of employee payments in one place. This integration enables the software to accurately track and calculate payroll for each individual, including holiday pay, PAYE, and other necessary deductions. Payments are then made accurately, on time and through the correct payment method.

There are several key components to payroll software. Let’s explore them in more detail.

1. Data capture

A digital payroll system needs to be able to capture and store essential employee data to process payments. This includes their name, address, PAYE number, salary information, banking details and more. Many payroll software solutions allow employees to access, enter and amend this data themselves, reducing the workload for your HR team. It’s important that this data is stored securely and correctly managed by your organisation’s data controller.

2. Timekeeping

Payroll software includes the functionality to keep track of how many hours each employee works to inform payment calculations. This also includes taking into account any days off, either paid or unpaid, and tracking holiday entitlement. In many instances, digital payroll systems can integrate with timekeeping software to increase efficiency and minimise the risk of errors arising from manual data entry.

3. Calculating pay

The payroll software is then able to calculate employee wages and deductions, using data about their pay rate, hours worked and any applicable deductions. Combining these different pieces of information in one place and integrating with other HR systems ensures an accurate payment each period with no manual calculations.

4. Payment processing

Once the wages have been calculated, the payroll system is able to automatically process payments directly to employees’ bank accounts or through paper cheques. Payments can be made automatically for a variety of different pay periods, including weekly and monthly. You can also make one-off manual payments where required.

5. Reporting

Finally, payroll systems include HR reporting functionality. This allows HR teams to analyse a variety of payroll performance metrics data such as employee paychecks, tax withholdings and payroll expenses to inform business growth. By unlocking essential insights and generating reports, organisations can take action towards achieving recruitment, productivity and engagement goals.

The features of cloud-based payroll software

Payroll software solutions include many different built-in features to empower your HR department through fast, efficient payroll processing. In fact, there are almost endless possibilities to the ways this powerful software can support your organisation, particularly the more sophisticated systems that enable seamless integration with other HR systems.

The key features of payroll software include:

- Timekeeping

- Employee self service

- Tax calculations

- Reporting

- Expense management

The benefits of payroll software

There are many advantages to implementing payroll software in your organisation, including faster payroll processing and fewer manual tasks to give HR professionals more time to focus on other aspects of their roles. As well as providing benefits to your business, a good payroll system helps to keep employees happy by enabling accurate, timely payments.

However, there can also be disadvantages to payroll software, particularly if you choose a system that isn’t suitable for your business needs. To avoid making the wrong decision, it’s important to factor in key considerations such as the ongoing cost, staff training and additional security requirements before making a purchase.

Let’s take a look at the benefits of payroll software in more detail.

Increased efficiency

Payroll software increases efficiency by minimising manual tasks, reducing the risk of human error, and integrating with other business systems to ensure accuracy of information. Once set up, payroll software is easy to manage, enabling everything from data input and payment processing to analysis and reporting through a single central interface. This allows HR employees to focus their expert attention elsewhere and provide a better workplace experience for employees.

Improved compliance

Payroll software supports HR compliance by maintaining a single point of truth for all payroll data, ensuring that employee documentation is safely stored and accessible at all times, and automating complex PAYE requirements to minimise incorrect processing. By integrating your organisation’s various HR systems into a single network, you can manage all aspects of your employer compliance quickly and easily.

Reduced costs

One of the ways in which payroll software reduces business costs is by removing the tedious manual processes that need to be repeated on a weekly or monthly basis to make employee payments. Automating these tasks allows HR professionals to make better use of their time by engaging with team members on a personal level and directly addressing any workplace concerns. The increased payment accuracy also helps to avoid costly payroll errors.

Improved employee satisfaction

Paying employees accurately and on time helps to keep them engaged and feeling appreciated at work. In addition, self-service options for logging hours, booking annual leave and accessing employee benefits gives them control over essential HR processes and reduces administrative wait times.

How much does payroll software cost?

With so many different payroll software options on the market, you’ll be able to find one that suits the size, budget and requirements of your business. Bear in mind that payroll systems that are suitable for larger, more complex organisations will be more expensive than solutions for smaller enterprises. The more employees or businesses you have, and the more features you need, the more you’ll need to pay.

Generally speaking, there are two pricing models for payroll software: subscription-based plans and per-employee pricing. When choosing which solution is right for your business, it’s important to weigh up the pros and cons of the different pricing models. Avoid paying for more than you need, and consider opting for payroll software that is designed to scale up and down with your business.

When comparing prices, keep in mind that there may be hidden costs for:

- Set-up and implementation

- IT infrastructure maintenance

- Ongoing support

- Additional users

- Feature upgrades and additions

- Early cancellation of your contract

Choosing the right payroll software

Just like any other purchase for your business, choosing the right payroll software comes down to your budget and unique requirements. From the size of your business and the level of support you need to the existing IT infrastructure in your organisation, there are many factors that will impact the decision.

Here’s a quick guide to choosing a good payroll software solution for your business:

- Assess your needs: Before you start comparing solutions, make a list of the essential functionality you need. Remember to consider how your business may adapt or expand in the future, and what you will need from your payroll software provider to support these changes.

- Consider your budget: Your budget will likely be the main deciding factor when it comes to making your final selection. It’s not always a case of choosing the solution with the lowest price or the most features; you want to strike a balance between paying for what you need without breaking your budget.

- Research different providers: As payroll software requires stringent data security practices and timely problem resolution, it’s important to find a provider you can trust. Read reviews and testimonials from current and former clients online, and pay particular attention to any mention of reliability and customer service.

- Compare features and pricing: Each software provider will offer a slightly different solution. Now you know your essential functions and budget, analyse the software packages to see which ones meet your needs. Remember to factor in any additional hidden costs, and take note of the different pricing plans on offer.

- Get a free trial: Always take advantage of any free trials offered by the payroll software provider. This is the best way to find out exactly how the features work and how user-friendly the system is before committing to a purchase.

What does ‘good’ payroll software look like?

Ultimately, good payroll software is whatever solution best suits your needs. This means offering a reliable solution, excellent customer service and good value for money while also meeting your requirements for functionality and cross-platform integration. It should be easy to use, saving you time and money by streamlining and automating essential payroll processes throughout the entire payment cycle.

Just like choosing the right HR software, it’s a fairly involved decision. However, taking the time to follow the steps we’ve outlined above when selecting your payroll software provider will help you to make an informed decision that benefits your business in the long term. If you find yourself paying for payroll software that hinders more than it helps, it might be time to look for another solution.

The best payroll software for your business

As we’ve seen, the best payroll software for your business is one that offers great functionality and a pleasant user experience while meeting your specific employee payment needs. The most important thing is to do your research and take your time over the decision.

For smaller businesses, simple, inexpensive payroll software offering basic functionality may be more than adequate. However, larger companies with a lot of employees or a complex structure would benefit from investing in a more comprehensive system. It’s also worth considering flexible plans that grow with your business, so you don’t end up locked into a contract for a system that you’ve outgrown.

If you’d like to take advantage of the benefits of a digital payroll solution, you’ve come to the right place. PeopleHR’s payroll software is a secure, flexible and user-friendly choice backed by excellent customer support to ensure the satisfaction for your business and its employees.