How To Do Payroll Yourself Using Software

Just like any other business admin task, payroll management in modern businesses has moved from manual processing to a streamlined digital approach. As well as being extremely time consuming, manual processing increases the risk of payroll errors, which could lead to failure to comply with UK law.

If you’re considering doing your own payroll, the best solution by far is to use payroll software. As well as making the whole process simpler and more user friendly, this specialist software has built-in functions to ensure compliance with UK tax and employment legislation. There are a variety of options on the market, including free and budget options that are ideal for managing payroll within small businesses.

In this article, we’re going to outline a step-by-step process of how to do payroll yourself using software, from the initial setup through to filing your taxes, so you can be confident you’re following the right process.

1. Register with HMRC

Registering as an employer with HMRC is a crucial step when paying employees, or if you’re operating as a limited company, in which case you’re classed as an employee even if nobody else works for you. You’ll need to do this whether you’re planning to do your own payroll or if you’re outsourcing it to an external agency.

You’ll then be able to access PAYE Online, where you can access tax codes and notices about your employees, check what you owe HMRC, pay your bill, and more. When you register your business, you’ll be given a PAYE reference number, which you’ll need to include in your tax return and other financial documents.

2. Setup the payroll software

Once you’re registered with HMRC, you’ll need to choose and set up your payroll software. Using specialised software to do payroll yourself will be more secure than using spreadsheets, as well as help to save time, minimise errors, and ensure that you comply with UK legislation and PAYE requirements. There are many different solutions available at different price points, so it’s important to weigh up your options so you can select the best payroll management software for your business.

In your initial setup, you’ll need to enter important information about your company and employees, including personal details and payment information. The software will have a variety of different tax settings for you to choose from, so it’s important that you select the right one. It’s important to make sure that you add all bank account details correctly so the software can automatically deposit paychecks into employee bank accounts.

3. Enter payroll information

Once your software is set up, you’re ready to start doing your own payroll. For each pay period, you’ll need to add the hours worked for each employee and their rate of pay, then take off any deductions such as student loan repayments and tax withholdings.

If you’re not sure how to do payroll yourself and are finding it hard to set up or make payments, you should contact customer support for your chosen payroll solution.

The more sophisticated the payroll system you choose, the more of this will be completed automatically, or imported from external sources such as a spreadsheet or integrated timekeeping system. While they can cost more than basic payroll software, the time-saving opportunities and reduced risk of error from manual entry are well worth the investment.

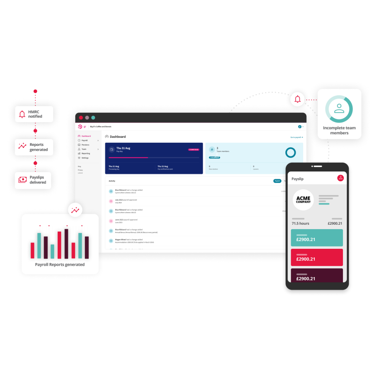

4. Generate payroll reports

Payroll reports are an essential part of doing payroll yourself. As well as providing information about the wages paid and helping you to track earnings, reporting on your payroll allows you to better ensure compliance with UK tax and employment legislation, and provide concrete information for HR data analytics and tax audit purposes.

There are three main types of payroll reports that you’ll need to generate:

- The first is a Full Payment Submission (FPS), which you’ll need to send to HMRC every payday to tell them what you’ve paid your employees, and what deductions you’ve made.

- An Employment Payment Summary (EPS) is sent instead of an FPS if you haven’t paid any employees during the pay period, or as well as an FPS if you need to reclaim payments or claim certain tax reliefs.

- The final one is a payroll deduction report, which shows HMRC what deductions you have made from employee wages.

- This should be reported on the same day each pay period unless you change your pay day, such as running your Christmas payroll early.

5. Distribute payslips

Employers in the UK are legally required to give their staff a payslip on or before their payday. Whether you hand them out physically in person, send them in the post, or email them electronically is up to you, but you must send them on time according to what you’ve set out in employee contracts.

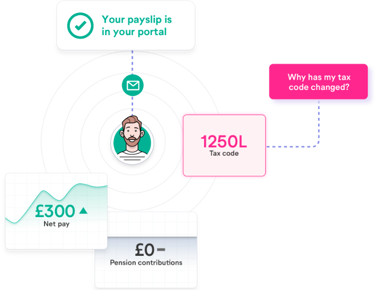

Take care to ensure that all payslips are fully accurate, but it’s a good idea to distribute them a few days before payday to allow time for queries if necessary. Some payroll systems even have self-service portal functionality so that employees can login, view and download their payslips online, whenever they need to access them.

Whenever and however you choose to send them, payslips must include the gross pay (the amount paid before deductions), the amount taken for deductions such as National Insurance and tax, and the net pay (the amount paid after deductions). Other essential payslip information includes the employee’s tax code and their National Insurance number.

6. File payroll taxes

In the UK, employers are required to file payroll taxes to HMRC on a regular basis. The frequency of filing will depend on the size and complexity of your business, but it’s usually monthly or quarterly. The payroll taxes you’ll have to file include income tax, National Insurance contributions and student loan deductions.

It’s essential that you file your payroll taxes on time and keep a copy for your own records. Payroll software can be used to electronically file your payroll taxes, helping to simplify or even automate the process. You can also then be sure that all your filed tax records are readily available for audit and analysis as needed.

7. Keep records of your payroll

The final step in how to do your own payroll, and one of the most important, is keeping records of all payroll information. This helps you to ensure that you’re operating within HR compliance requirements for the UK, and allows you to demonstrate that you’ve paid the correct amount of taxes and NI contributions.

Payroll records also help businesses to track employee earnings, understand any historical payroll errors that need to be addressed, and resolve any employment disputes. You should keep these records for at least 7 years. It’s important to make sure that they are stored securely to minimise the risk of unauthorised access or data breach. Most payroll software will ensure that these records are stored securely and include automated ways to dispose of data securely.

Utilise software to streamline payroll processes

When learning how to do your own payroll, there are a lot of complex considerations, many of which have serious legal implications if not handled properly. However, utilising payroll software can help you to avoid the risk of incorrect payslips, paying employees late and legal and compliance issues by streamlining and guiding you through the process.

The easiest way to relieve stress when doing payroll yourself is to use payroll software. This allows you to automate the process to minimise human error, reduce manual workloads, and simplify HMRC reporting.

A payroll software provider will likely also provide some level of support and expertise with setting up your payroll securely, and for any issues once you’re up and running. Integrating your payroll system with cloud-based HR software can ensure staff working hours, overtime and absences are accounted for automatically in your payroll, further streamlining the process and ensuring greater accuracy.

Whether or not you decide to do payroll yourself, specialised HRIS software is a valuable tool for small business owners, offering time-saving functionality and built-in compliance capabilities.

Related resources

We are trusted by experts